02.1 Non-Dom Status in Cyprus

RESIDENCY & NON-DOM STATUS IN CYPRUS (EU)

Cyprus

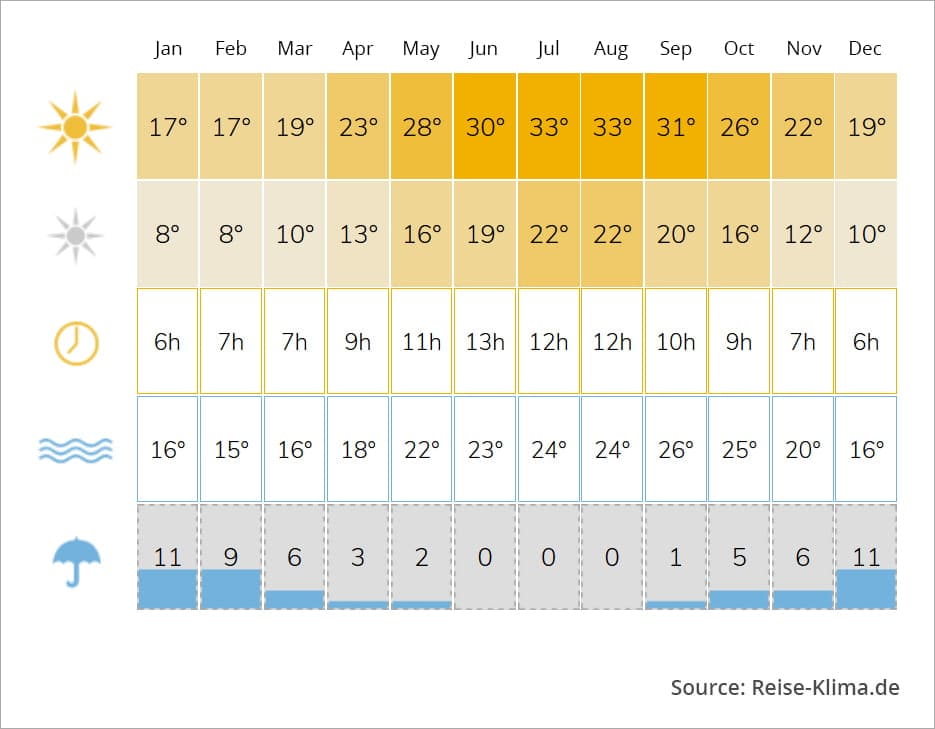

The Mediterranean island of Cyprus, a full member of the European Union (EU), has been an independent state since 1960. More than three million tourists visit the island every year, attracted by its Mediterranean lifestyle, sunny weather and unique flora and fauna. Cyprus is one of the safest countries in the world, both from a political standpoint and due to the fact that it has one of the lowest crime rates in the world.

The high safety standards, friendly inhabitants and relaxed atmosphere, modern infrastructure, steadily blooming economy and unique, advantageous tax regulations have also attracted many migrants to Cyprus. As a result, the island’s population has increased from 700,000 to 1,000,000 since 2013.

Find out more

ECONOMIC BENEFITS AND TAXES IN CYPRUS

Cyprus offers immigrants a wide range of exemptions regarding taxes on personal income. The prerequisites to make use of these exemptions are the relocation of the tax residence to the EU member state of Cyprus and the filing of an application for the so-called Non Dom status.

The Non Dom status in detail

Interest and investment results gained abroad are not subject to taxation in Cyprus. This applies both to private persons in Cyprus with Non Dom status, and companies registered in Cyprus (Cyprus Limited, Cyprus Holding, etc.), the latter under certain conditions.

More Info

Whereas the “old“ countries running Non Dom programmes only guaranteed the legal regulations applying to the Non Dom status until these were “recalled“, Cyprus guarantees all benefits arising from its Non Dom programme for 17 years. This means great security in long-term planning for persons with the Non Dom status. Today, the entire world is constantly subject to changes in tax regulations. The 17 year guarantee is another great pro for Cyprus.

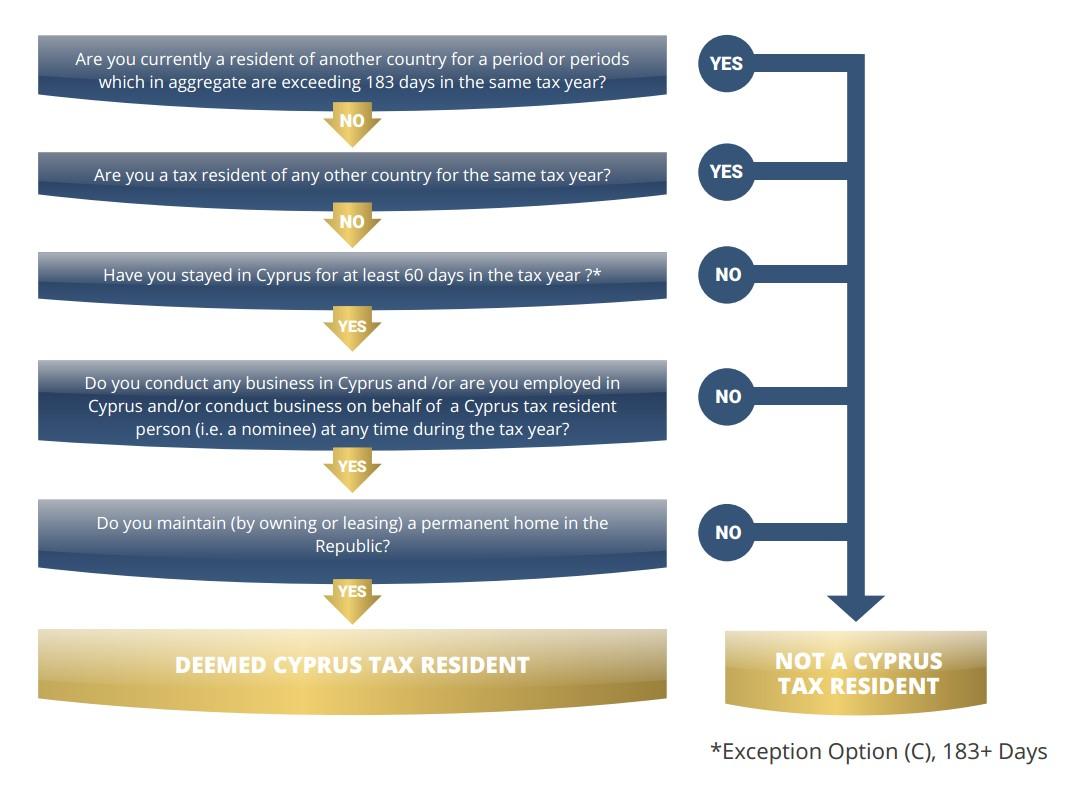

Cyprus has adjusted its tax regulations to the modern world of business. By dispensing with the European 183 day regulation, it has especially opened its doors to entrepreneurs looking for maximal flexibility.

The legal relocation of the tax residence and several of the benefits enjoyed with the Non Dom status, is even available to those persons spending only 60 days per year in Cyprus. This applies regardless of whether the person has spent these 60 days in Cyprus as a single period or through several visits.

This simplified overview shows how the tax residence in Cyprus can be maintained in the long-term:

One of the most significant advantages of the Non Dom status in Cyprus is that the country foregoes all Remittance Base taxation. Cyprus‘ tax law does not impose taxes on any dividends coming in from abroad. This means that capital earnings can be freely moved, held and distributed internationally.

See just how detrimental Remittance Base taxation in other countries can be via the following link:

Cyprus does not release tax and bank account information to other countries, provided you have your tax residence exclusively in Cyprus.

Find out the reasons behind this

According to standard international criteria, Cyprus is not a tax haven! Cyprus has merely developed a legal and tax framework which is particularly advantageous for entrepreneurs.

More Info

Cyprus offers the corporations based in Cyprus, specifically Cyprus Limited Liability Companies, significant advantages regarding taxes and duties. The corporate tax in Cyprus for corporations is only 15% and the tax for income from licences, IP and similar turnover is only 2.5%.

In addition, payments to offshore companies are tax deductible for Cyprus companies as business expenses.

RESIDENCY: NON-DOM STATUS

|

Particulars |

Option A |

Option B |

Option C |

|---|---|---|---|

|

CY COMPANY SETUP |

SIMPLY NON-DOM |

FIP |

|

|

Services and Fees |

Services and Fees | Services and Fees | Services and Fees |

|

Company Setup & Non-Dom Registration from A-Z |

Flowchart Overview |

||

|

Original Passport |

|

|

|

|

Employment Contract |

|

not applicable |

not applicable |

|

Proof of Payment of relevant Insurance Contributions & Employment Contract |

|

|

not required |

|

Application Fee € 20 |

|

|

|

|

Proof of valid Health Insurance

Options: If the Health Insurance Provider is in another country, the Insurance Agreement must be provided. It must cover both in- and out-patient treatment costs |

not required |

not required |

|

|

Rental Agreement or Title Deed |

|

|

|

|

Proof of Income - certified/stamped bank account statements from the last 6 months must be provided |

not required |

not required |

|

|

Minimum stay per year |

60+ Days |

60+ Days |

183+ Days |

|

Notes |

|||

|

Note 1: |

The applicant/freelancer has already carried out the business activities that he intends to register in Cyprus. Proof of prior business activities such as trade licences, evidence of existing customer relations and similar documentation must be provided. Other prerequisites include a short CV and relevant proof of qualification for the business activities to be carried out in Cyprus. Furthermore, the application requires the submission of utility bills such as water & electricity bills. The utility bills must be in the name of the applicant and be addressed to his current address in Cyprus. |

If the applicant owns a foreign or offshore company, he or she must provide documentation of respective profits. This can be demonstrated by providing bank statements showing a minimum monthly personal income of €2,500–3,000 for the past three to six months, as well as €15,000–20,000 in the applicant's bank account. Remember, we are talking about financially independent individuals. |

|

|

Services and Fees |

|||

| Advice and Support on Relocating | Services and Fees | Services and Fees | Services and Fees |

|

Ease of Process |

Simple Path |

Intermediate Path |

Intermediate Path if above requirements can be met |

Important: only one of these criteria needs to be met, in order for a company to qualify as an "Active Company"!

Important: only one of these criteria needs to be met, in order for a company to qualify as an "Active Company"!