02.1a Option A

Cyprus Company Set-Up incl. Relocating & Non-Dom Status

Services and Fees

Do you want to move your tax residence to Cyprus and take advantage of the great benefits of the Non-Dom programme?

Privacy Management Group, lawyers and chartered accountants in Cyprus, offers you a complete package to help you carry out your plans, including legal support and tax advice.

For over 30 years, Privacy Management Group has specialised itself in providing first rate tax advice and legal support for newcomers to Cyprus. We are fully certified by ICAP Cyprus. Furthermore, we have chosen to subject all our departments to an annual quality control carried out by TUV NORD. We are fully 9001:2008 certified.

Free Consultation

Free Consultation in the Preparation Phase

For the last 10 years, Privacy Management Group in Cyprus has built relationships with specialists from Switzerland, Germany, France and other European countries. Our in-house staff therefore has personal insight into... READ MORE>>>

For the last 10 years, Privacy Management Group in Cyprus has built relationships with specialists from Switzerland, Germany, France and other European countries. Our in-house staff therefore has personal insight into the specific areas where you will need support. On the basis of our 3 decades worth of expertise as lawyers, tax advisors and management consultants and the personal experiences of our own colleagues, we have developed a complete service programme to help you every step of the way.

Even during your initial planning stages, you can trust in us and our experience and expertise to set you on the best path. For your planning process, we offer the following services:

- free orientation session in person at our Service Centre, on the phone or via Skype;

- free use of the Live-Chat for any questions which come up during the planning stages;

- free initial consultation with our in-house lawyers, tax consultants and specialists.

In addition, we are of course also available to answer any questions you may have about schools, the housing market, life in Cyprus, the social welfare system, etc..

For the last 10 years, Privacy Management Group in Cyprus has built relationships with specialists from Switzerland, Germany, France and other European countries. Our in-house staff therefore has personal insight into the specific areas where you will need support. On the basis of our 3 decades worth of expertise as lawyers, tax advisors and management consultants and the personal experiences of our own colleagues, we have developed a complete service programme to help you every step of the way.

Even during your initial planning stages, you can trust in us and our experience and expertise to set you on the best path. For your planning process, we offer the following services:

- free orientation session in person at our Service Centre, on the phone or via Skype;

- free use of the Live-Chat for any questions which come up during the planning stages;

- free initial consultation with our in-house lawyers, tax consultants and specialists.

In addition, we are of course also available to answer any questions you may have about schools, the housing market, life in Cyprus, the social welfare system, etc..

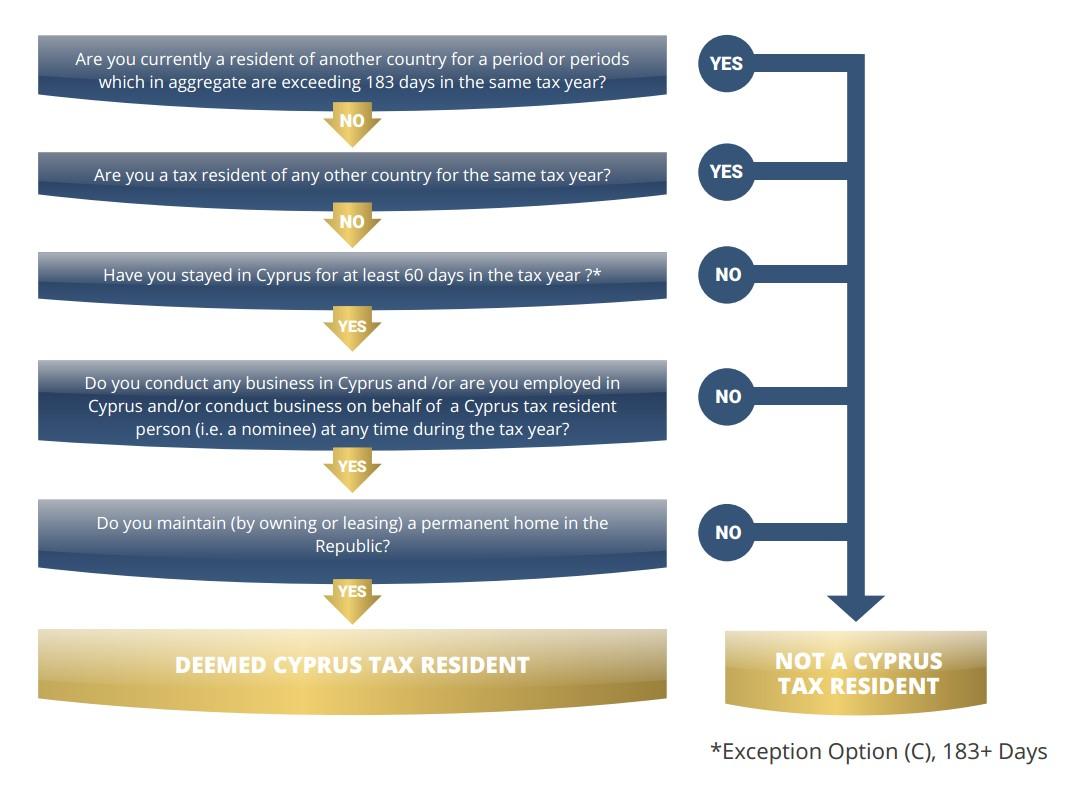

Requirements for the Non-Dom Status in Cyprus

Company Set-Up incl. Residency and Non-Dom Status

Company Set-Up in Cyprus

fee

Our legal department has been a member of the Cyprus Bar Association for over 30 years, our tax consultants are in-house employees of Privacy Management Group. Privacy Management Group is therefore able to offer... read more>>>

Our legal department has been a member of the Cyprus Bar Association for over 30 years, our tax consultants are in-house employees of Privacy Management Group. Privacy Management Group is therefore able to offer several services at its own Service Centre, and does not rely on intermediaries. The set-up cost of your company, whether Cyprus Limited or Cyprus Holding, is a one-off fee of 2,650.00 Euros excl. VAT.

Company Set-Up in Cyprus includes:

- Free advice and support regarding legal and tax issues;

- Verification of the Company Name with the Cyprus (EU) Commercial Register;

- Preparation of the Articles and Documents of your Cyprus Limited and Cyprus Holding;

- Preparation of the Partnership Agreement and submission to the Commercial Register;

- Payment of the registration fee for the Cyprus Limited or Cyprus Holding to the Register;

- Certification of the Register Documents incl. translation into English;

- Service-Handbook incl. all original documents;

- Delivery at our Service Centre or by Courier.

incl. Bank Accounts

- Assistance with the opening of business bank accounts in Cyprus;

- Assistance with the opening of private bank accounts in Cyprus;

- Assistance with the opening of bank accounts in over 20 countries around the world.

incl. Registered Office, Registered Agent and Trustees

- Provision of a Registered Office and Registered Agent for your Cyprus Company;

- upon request, provision of Fiduciary Services.

incl. Legal Support and Tax Advice

- Application for a Tax File Numbers for private persons and companies;

- Application for Value Added Tax (VAT);

- Preparation of the Opening Balance of your Company;

- Set-up of an up-to-date Accounting System and VAT Accounts;

- Preparation of Employment Contracts;

- Set-up of the Payroll Accounting System;

- Application for the mandatory social security number(s);

- Ongoing legal support and tax advice for Cyprus.

incl. Service for your Office in Cyprus

- Arrangement of a suitable office space;

- Assessment of the rental offer and rental agreement by one of our in-house lawyers;

- Certification of the rental agreement after signing;

- Support for the registration of a telephone and internet connection;

- The average rent of a 1 room office space is about 200.00 Euros per month.

Your company's office can be combined with your private apartment. The set-up of a company in Cyprus can be completed within 10 working days.

Our legal department has been a member of the Cyprus Bar Association for over 30 years, our tax consultants are in-house employees of Privacy Management Group. Privacy Management Group is therefore able to offer several services at its own Service Centre, and does not rely on intermediaries. The set-up cost of your company, whether Cyprus Limited or Cyprus Holding, is a one-off fee of 2,650.00 Euros excl. VAT.

Company Set-Up in Cyprus includes:

- Free advice and support regarding legal and tax issues;

- Verification of the Company Name with the Cyprus (EU) Commercial Register;

- Preparation of the Articles and Documents of your Cyprus Limited and Cyprus Holding;

- Preparation of the Partnership Agreement and submission to the Commercial Register;

- Payment of the registration fee for the Cyprus Limited or Cyprus Holding to the Register;

- Certification of the Register Documents incl. translation into English;

- Service-Handbook incl. all original documents;

- Delivery at our Service Centre or by Courier.

incl. Bank Accounts

- Assistance with the opening of business bank accounts in Cyprus;

- Assistance with the opening of private bank accounts in Cyprus;

- Assistance with the opening of bank accounts in over 20 countries around the world.

incl. Registered Office, Registered Agent and Trustees

- Provision of a Registered Office and Registered Agent for your Cyprus Company;

- upon request, provision of Fiduciary Services.

incl. Legal Support and Tax Advice

- Application for a Tax File Numbers for private persons and companies;

- Application for Value Added Tax (VAT);

- Preparation of the Opening Balance of your Company;

- Set-up of an up-to-date Accounting System and VAT Accounts;

- Preparation of Employment Contracts;

- Set-up of the Payroll Accounting System;

- Application for the mandatory social security number(s);

- Ongoing legal support and tax advice for Cyprus.

incl. Service for your Office in Cyprus

- Arrangement of a suitable office space;

- Assessment of the rental offer and rental agreement by one of our in-house lawyers;

- Certification of the rental agreement after signing;

- Support for the registration of a telephone and internet connection;

- The average rent of a 1 room office space is about 200.00 Euros per month.

Your company's office can be combined with your private apartment. The set-up of a company in Cyprus can be completed within 10 working days.

We can accompany you to appointments with the authorities regarding the Non-Dom status

Residency and the Non-Dom Status

fee

Accredited by the ICAP Cyprus, we will be at your side throughout your relocation to Cyprus and will ensure that you can take full advantage of the enormous advantages that the Non-Dom programme promises. For our... read more>>>

Accredited by the ICAP Cyprus, we will be at your side throughout your relocation to Cyprus and will ensure that you can take full advantage of the enormous advantages that the Non-Dom programme promises. For our services regarding "Residency and the Non-Dom Status" we charge a one-off fee of 490,00 Euros excl. VAT.

You will receive our support with the following:

- Preparation of the documents and application forms required by the authorities;

- Activation of your social security number (required upon registration!);

- Support in your search for a place to live in Cyprus (whether you with to rent or buy);

- Setting of appointments with the relevant authorities;

- We will personally accompany you when you officially register yourself and your family;

- Preparation of the application for a personal tax file number incl. application for Non-Dom status.

It should take about 5 working days to complete this checklist and round off the registration.

Accredited by the ICAP Cyprus, we will be at your side throughout your relocation to Cyprus and will ensure that you can take full advantage of the enormous advantages that the Non-Dom programme promises. For our services regarding "Residency and the Non-Dom Status" we charge a one-off fee of 490,00 Euros excl. VAT.

You will receive our support with the following:

- Preparation of the documents and application forms required by the authorities;

- Activation of your social security number (required upon registration!);

- Support in your search for a place to live in Cyprus (whether you with to rent or buy);

- Setting of appointments with the relevant authorities;

- We will personally accompany you when you officially register yourself and your family;

- Preparation of the application for a personal tax file number incl. application for Non-Dom status.

It should take about 5 working days to complete this checklist and round off the registration.

The Annual Fees after Set-Up

Tax Advice and Accounting

All services in one place! At our Service Centre you will find a team of experienced lawyers, tax advisors and accountants, who will be happy to support you and your company at any time. PMG is, of course, fully accredited by... read more>>>

All services in one place! At our Service Centre you will find a team of experienced lawyers, tax advisors and accountants, who will be happy to support you and your company at any time. PMG is, of course, fully accredited by the ICPAC. The annual fees, due every 12 months, include the following services:

Tax Advice, Ongoing Accounting Services and Attestation

- Tax advice for your company;

- Support anytime, anywhere: contact us via email, on the phone or in person at our Service Centre;

- Ongoing payroll accounting services and reporting to the social insurance provider;

- Ongoing VAT reporting;

- Submissionof the tax returns (incl. VAT) to the relevant tax office;

- Ongoing bookkeeping services;

Please select the expected number of transactions per year

see the total costs

incl. transactions

- Preparation of the annual balance sheet at the end of the calendar year;

- Balance sheet review and consultation;

- Submission of the balnace sheet to our auditor, incl. audit and certificate;

- Submission of the annual balance sheet, preparation of requests;

- Communication with the tax office in Cyprus;

- Review of the tax assessment;

- Final consultation;

- Legal appeal if needed, including representation.

incl. Administration and other Services

- Fees for the required Registered Office in Cyprus;

- Fees for the required Registered Agent in Cyprus;

- Trusteeship fees (if requested), general power of attorney;

- Personal advice and support on location in Cyprus.

incl. Private Tax Returns and Non-Dom in Cyprus

- Tax advice for you as a private person with Non-Dom status in Cyprus;

- Support via email, on the phone or in person at our Service Centre;

- Preparation of your annual tax returns at the end of the calendar year;

- Communication with the tax office in Cyprus;

- Review of the tax assessment;

All services in one place! At our Service Centre you will find a team of experienced lawyers, tax advisors and accountants, who will be happy to support you and your company at any time. PMG is, of course, fully accredited by the ICPAC. The annual fees, due every 12 months, include the following services:

Tax Advice, Ongoing Accounting Services and Attestation

- Tax advice for your company;

- Support anytime, anywhere: contact us via email, on the phone or in person at our Service Centre;

- Ongoing payroll accounting services and reporting to the social insurance provider;

- Ongoing VAT reporting;

- Submissionof the tax returns (incl. VAT) to the relevant tax office;

- Ongoing bookkeeping services;

Please select the expected number of transactions per year

see the total costs

incl. transactions

- Preparation of the annual balance sheet at the end of the calendar year;

- Balance sheet review and consultation;

- Submission of the balnace sheet to our auditor, incl. audit and certificate;

- Submission of the annual balance sheet, preparation of requests;

- Communication with the tax office in Cyprus;

- Review of the tax assessment;

- Final consultation;

- Legal appeal if needed, including representation.

incl. Administration and other Services

- Fees for the required Registered Office in Cyprus;

- Fees for the required Registered Agent in Cyprus;

- Trusteeship fees (if requested), general power of attorney;

- Personal advice and support on location in Cyprus.

incl. Private Tax Returns and Non-Dom in Cyprus

- Tax advice for you as a private person with Non-Dom status in Cyprus;

- Support via email, on the phone or in person at our Service Centre;

- Preparation of your annual tax returns at the end of the calendar year;

- Communication with the tax office in Cyprus;

- Review of the tax assessment;

No transactions (inactive company)

The Annual Fees for the Services outlined above

The annual fees are based on the actual number of transactions within a calendar year. For this reason, the annual fees may decrease or increase during the course of the calendar year. Calculation basis / number of expected transactions in the next 12 months: No transactions (inactive company).

| Summary of all fees | ||

| Formation fees | one-off | €2,650.00 |

| Residence relocation, Non-Dom and appointments with the relevant authorities | one-off | €490.00 |

| Tax consulting, ongoing accounting services (annual administration fees) | per 12 months | €2,250.00 |

| TOTAL | €5,390.00* | |

*excl. 19% VAT.

Annual Levy for Companies in Cyprus

The „Annual Levy“, which was introduced in Cyprus in 2011, totals 350.00 Euros per year per Company. The reporting date is June 30 of each year. This public levy is not included in the aforementioned fees and must be paid separately.

Important: only one of these criteria needs to be met, in order for a company to qualify as an "Active Company"!

Important: only one of these criteria needs to be met, in order for a company to qualify as an "Active Company"!